Retail Insights | April 2025

TIGHT VACANCY AND RISING RENTS: WHAT IT MEANS FOR OWNERS

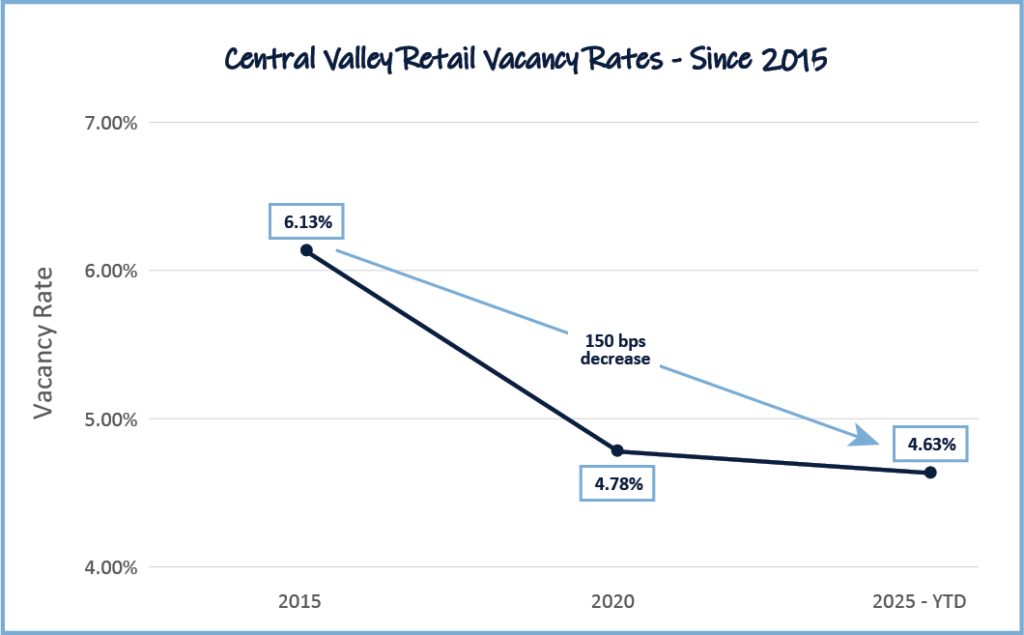

Retail vacancy rates across the Central Valley have steadily declined over the past decade. In 2015, the average vacancy rate sat at 6.13%. As of Q1 2025, that number has dropped to just 4.63%—a 150 basis point improvement. For commercial retail property owners, this environment presents a clear advantage: strong rent growth potential, higher tenant demand, and upward pressure on asset values.

WHAT’S DRIVING THESE TRENDS?

• High Construction Costs

Construction costs remain elevated with no relief in sight. According to Trading Economics, as of March 2025, lumber prices reached their highest levels since the pandemic. Labor shortages and inflation across materials have made ground-up development increasingly expensive.

• High Borrowing Costs

With interest rates climbing steadily over the past three years, financing new construction has become less attractive—further stalling developer activity and limiting new inventory in the market.

• Rent Growth Lags Behind Construction Costs

Although rents have risen across existing properties, they haven’t increased fast enough to support the economics of new construction. This gap is making new development financially nonviable in many cases—locking in a supply-constrained environment that benefits current owners.

WHY IT MATTERS TO YOU

Low vacancy and limited new development can put existing retail property owners in a strong position. Here’s how:

• Value Growth: Rising rental rates and filling vacancies directly increases Net Operating Income (NOI)—which often translates to higher property values.

• Rental Increases at Lease Renewals: With tenant competition for space increasing, many owners are achieving healthy rent bumps at lease renewal.

• Repositioning Opportunities: Properties with upcoming vacancies may present a rare opportunity to upgrade tenant mix or reconfigure space for higher revenue potential.

………………………………………………

If you would like to learn more about how recent rental trends could affect your property value, reach out to the Visintainer Group for a complimentary property valuation. Whether you’re looking to sell, hold, or explore your options, the Visintainer Group offers expert advice to help you navigate complexities, evaluate opportunities, and maximize your investment.

*Data courtesy of Visintainer Group, Costar Analytics and Trading Economics