Impact of the Slowdown on Commercial Real Estate

As originally covered in The Business Journal

The world of commercial real estate has been a rollercoaster of trends and shifts, with 2023 proving to be no exception. After a robust 2022 marked by strong investment sales, the current year has brought about a significant deceleration. Investors find themselves grappling with heightened uncertainty in the economic landscape, rising interest rates and tighter debt markets. These factors have led to a decline in sales, leasing, and financing, impacting prominent brokerages’ profitability by staggering margins of 50% to 100%.

A notable barometer of the commercial real estate market’s health is the RCA Commercial Property Price Index, which reveals a dip of 8% in the value of commercial real estate over the past year. The situation is even more pronounced in the multi-family sector, where values have shrunk by 10%. This decline shows the market’s current fragility, prompting investors to ponder a central question: How much longer will this trend continue?

Central Valley Multi-Family Market Analysis

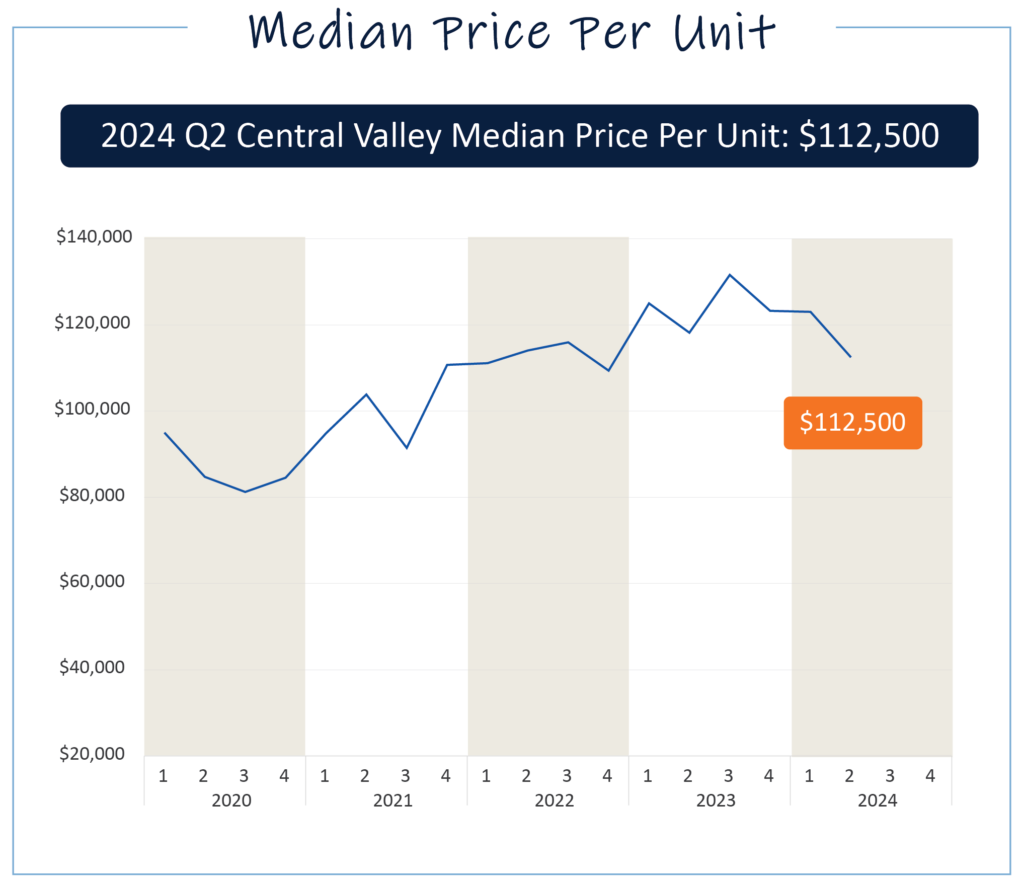

In contrast to the strong apartment investment sales in 2022, 2023 activity in Q1 and Q2 has cooled down considerably. A significant change in the investment landscape has manifested through an increase in capitalization rates (cap rates), which now average 5.61%. This marks the fourth consecutive quarter of cap rate escalation. Alongside this, there has been a remarkable 62% year-over-year decrease in sales volume, plummeting from $353,960,818 in 2022 to $133,484,774 in 2023. The number of transactions has also decreased, with just 25 transactions recorded in the first two quarters of 2023 compared to 61 in the previous year. Multi-family was the darling of the dance after COVID but the music seems to be fading. The significant decline in sales raises questions about the impact of the new normal and higher interest rates on the once-thriving multi-family market.

Central Valley Retail Market Trends

Similar to the multi-family sector, the retail market has witnessed a substantial reduction in sales volume, affecting both single and multi-tenant properties. Multi-tenant properties, in particular, have experienced a significant drop of 66% in sales volume year-over-year, while single tenant properties have seen a 43% reduction over the same period. The average cap rate for multi-tenant properties, 6.86%, is the highest average cap rate since the early stages of COVID recovery in Q1 2021. Further, transactions have decreased by a staggering 58% year-over-year. The data illustrates that sellers can expect a reduced buyer pool, prompting pricing adjustments aligned with the debt market, given buyers’ inability to match the previous year’s prices; consequently, the coming months are likely to reveal a notable shift in pricing expectations.

Potential Effects of the Exchange Extension on Market Activity

The recent extension granted by the Internal Revenue Service (IRS) for 1031 exchanges in regions affected by severe storms might hold promise for increased market activity. The extension is until October 16th for the 45-day identification period and 180-day closing term for 1031 exchanges. Investors who were awaiting this extension could potentially unleash pent-up demand, leading to an upswing in transactions. This scenario has historical precedent, as a similar IRS extension during the summer of COVID prompted a surge in activity as the deadline approached.

Charting the Future Course for Investors

The combination of rising interest rates and divergent seller-buyer perspectives on property values has left investors hesitant to commit to new investments. This will likely curtail sales activity as the year progresses, extending into 2024. Apart from the anticipated effects of year-end exchanges, investors are adopting a patient stance, observing how the economy and interest rates unfold before committing to major investment decisions.

Consulting with an Investment Advisor for Strategic Decisions

Market volatility can create complexities in commercial real estate investing. Consult with an experienced advisor who understands your financial goals and can provide market expertise, with an understanding of elements that impact value.

Brett Visintainer, CCIM is a Commercial Investment Advisor and the Principal of Visintainer Group in Fresno, CA. Formed in 2018 and built on a foundation of investment real estate, the Visintainer Group is a client-first commercial real estate firm. The Group has executed over $715 million in transactions across the United States. Brett specializes in commercial property acquisitions and dispositions and 1031 exchanges for owners in the Central Valley, Sacramento, and Central Coast markets. He can be reached at 559.890.0320 or [email protected].