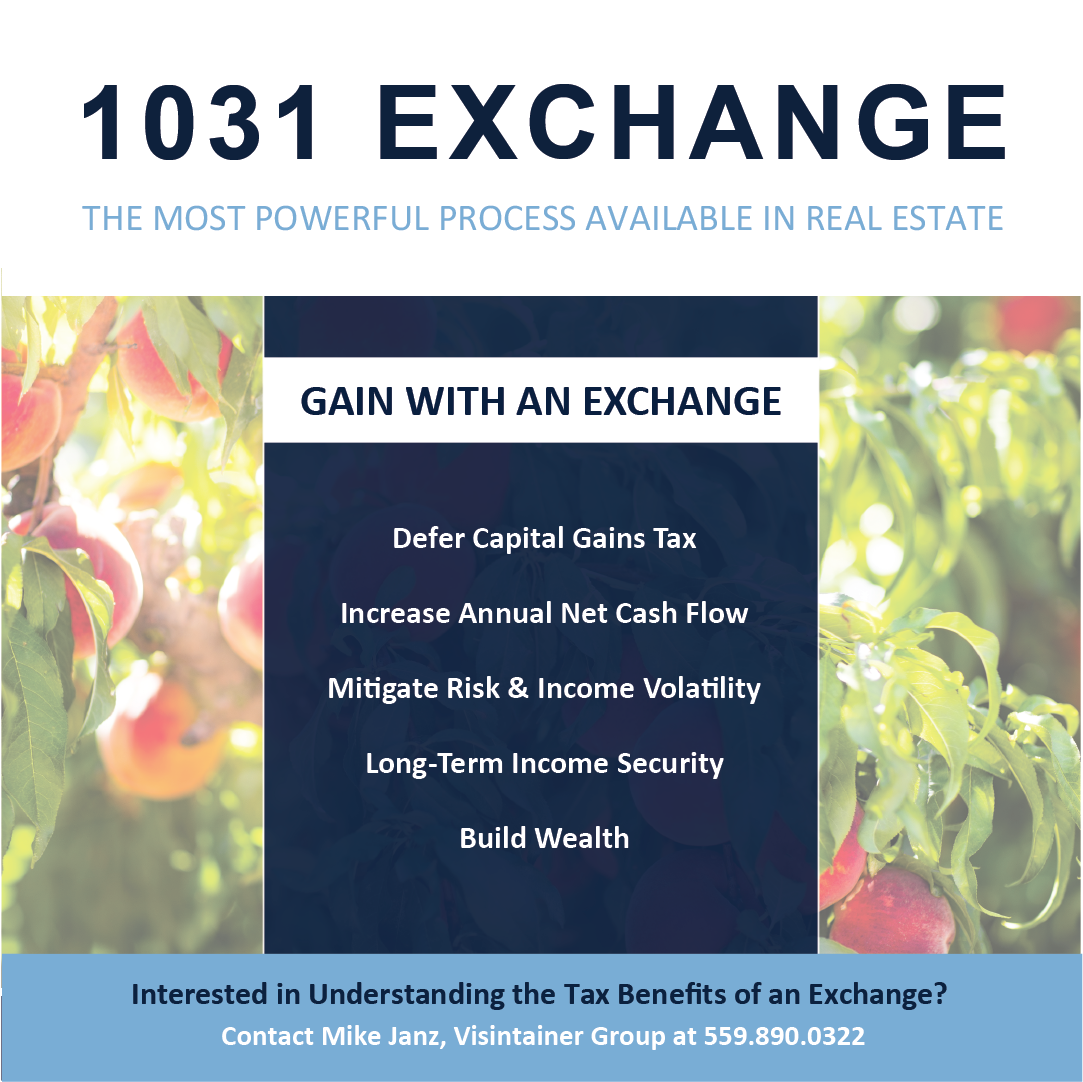

Central Valley Multifamily Market Update: Income Stability & Investment Trends

Multifamily expenses have risen 24% since 2021, yet income remains strong for many Central Valley owners. Learn what’s driving stability and the new investment options owners are considering.